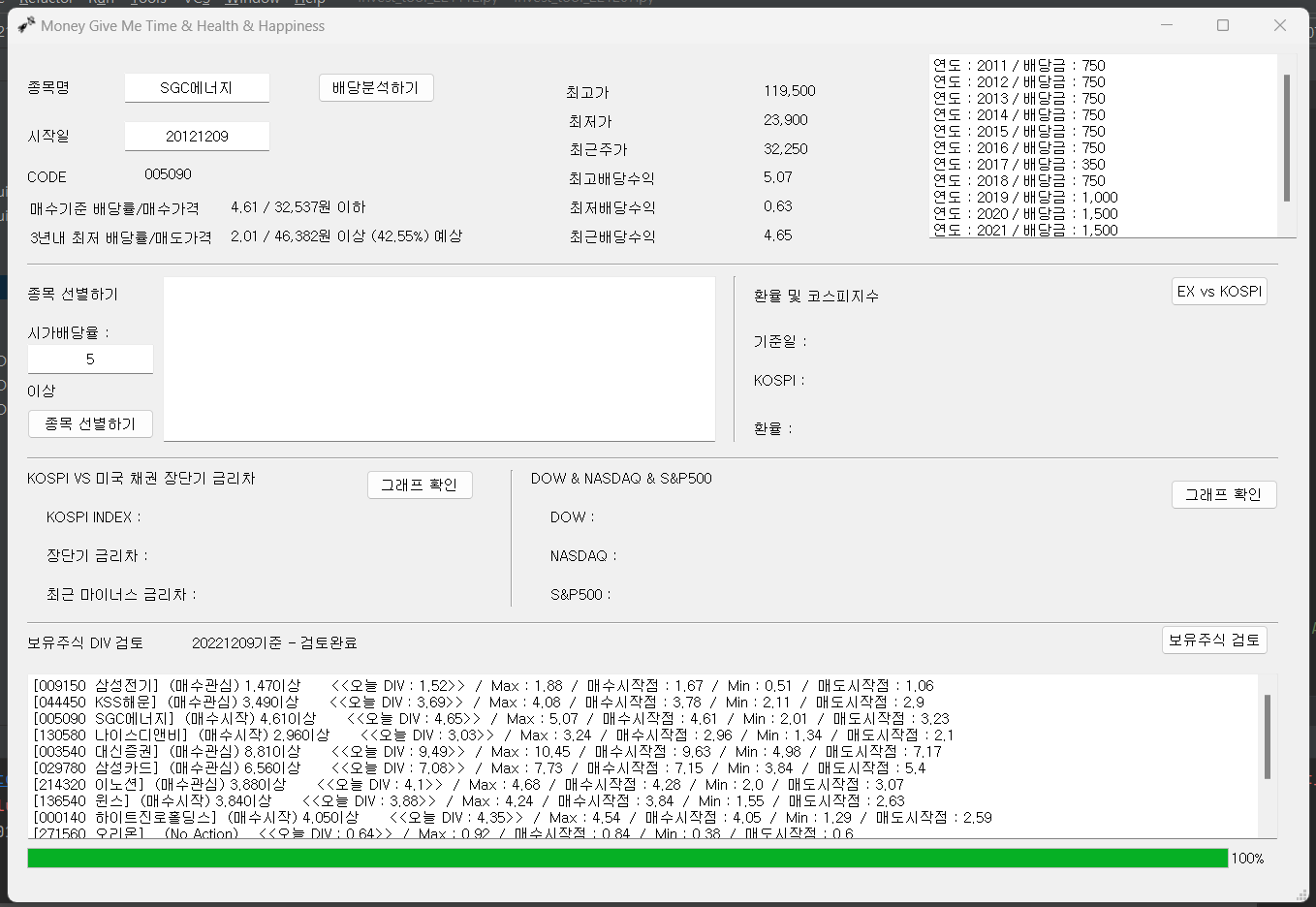

주식투자도구를 업데이트 했습니다.

매수기준 배당률과 매수를 해야할 가격, 3년내 최저 배당률과 매도를 해야할 가격을 표시했습니다. 거기에다 예상(최소) 수익률도 자동으로 계산이 되어서 표시 하도록 했습니다.

그리고 pykrx를 통해서 데이터를 가져온 후 분석을 하는 방식을 바꿔서 DB에 저장된 데이터를 기준으로 분석하도록 방법을 조금 변경했습니다.

또한, 도구창이 열리는 순간 DB에 데이터가 업데이트 되도록 코드를 수정했습니다.

별거 한 건 없는 것 같은데 에러가 계속 나서 오래걸렸습니다.

오래 걸린만큼 더욱 유용하리라 생각됩니다.

전체 코드는 아래와 같습니다.

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

240

241

242

243

244

245

246

247

248

249

250

251

252

253

254

255

256

257

258

259

260

261

262

263

264

265

266

267

268

269

270

271

272

273

274

275

276

277

278

279

280

281

282

283

284

285

286

287

288

289

290

291

292

293

294

295

296

297

298

299

300

301

302

303

304

305

306

307

308

309

310

311

312

313

314

315

316

317

318

319

320

321

322

323

324

325

326

327

328

329

330

331

332

333

334

335

336

337

338

339

340

341

342

343

344

345

346

347

348

349

350

351

352

353

354

355

356

357

358

359

360

361

362

363

364

365

366

367

368

369

370

371

372

373

374

375

376

377

378

379

380

381

382

383

384

385

386

387

388

389

390

391

392

393

394

395

396

397

398

399

400

401

402

403

404

405

406

407

408

409

410

411

412

413

414

415

416

417

418

419

420

421

422

423

424

425

426

427

428

429

430

431

432

433

434

435

436

437

438

439

440

|

import sys

from PyQt5.QtWidgets import *

from PyQt5 import uic

from PyQt5.QtGui import QIcon

from pykrx import stock

from datetime import datetime, timedelta

import matplotlib.pyplot as plt

import pandas as pd

from pandas_datareader import data as pdr

import FinanceDataReader as fdr

import time

import numpy as np

import sqlite3

import random

ui = 'INVEST TOOL_221208.ui'

class MainWindow(QMainWindow):

def __init__(self):

QMainWindow.__init__(self, None)

uic.loadUi(ui, self)

self.btn.clicked.connect(self.input_data)

self.btn_ex_kospi.clicked.connect(self.kospi_ex)

self.btn_div.clicked.connect(self.filtered_by_div)

self.btn_diff_tr.clicked.connect(self.diff_tr_kospi)

self.btn_dns.clicked.connect(self.dns)

self.btn_my_div.clicked.connect(self.my_div)

self.initUI()

# 창이 밋밋해서 아이콘도 넣었다.

def initUI(self):

self.setWindowIcon(QIcon('to_money.png'))

self.db_update() #시작하면 DB부터 업데이트

def input_data(self):

con = sqlite3.connect('krx_data.db')

today_df = pd.read_sql("SELECT 일자 FROM fundamental", con) # DB에서 마지막 행 구하기

today = today_df['일자'].iloc[-1] # 마지막 행에서 날짜 구하기

print(today)

# 이름을 받아서 code 입력

def code_by_name(name):

code_df = pd.read_sql("SELECT 일자, code, 종목명 FROM fundamental WHERE 종목명 = '" + name + "' AND 일자 = "

+ today, con)

return code_df['code'].iloc[-1]

name = self.le_name.text()

code = code_by_name(name)

self.textEdit.clear()

self.lbl_code.setText(code)

if not self.le_start.text(): #le_start 가 비었으면

start_df = pd.read_sql("SELECT code, 일자 FROM fundamental WHERE code = '" + code + "'", con)

start_date = start_df['일자'].iloc[0]

if int(today[:4]) - 10 < int(start_date[:4]): #과거 10년 데이터가 없으면

print('10년전 데이터가 없음')

if int(today[4:6]) > 5: #첫번째 데이터 일자가 5월보다 크면 그 다음해부터 시작

start = str(int(start_date[:4]) + 1) + '0101'

else:

start = start_date

print(start)

else:

start = str(int(today[:4]) - 10) + today[-4:] # 10년전 날짜

print('10년전 데이터가 있음')

else:

start = self.le_start.text() #아니면 원하는 날짜에 시작

# 년도별 배당금 표시하기

dps_li = []

try:

i = 1

for y in range(int(start[:4]), int(today[:4]) + 1):

df_f = pd.read_sql("SELECT code, 일자, DPS FROM fundamental WHERE code = '" + code +

"' AND 일자 LIKE " + "'" + str(y) + '05%' + "'", con)

prb = int(i)/((int(today[:4]) + 1) - int(start[:4])) * 100 #Progress Bar

self.prb.setValue(prb) #Progress Bar

dps = int(df_f['DPS'].iloc[-1]) # 배당금을 dps 변수에 저장

dps_li.append([y - 1, dps]) # 년도와 배당금을 리스트로 저장(년도는 전년도로 저장)

i += 1

except:

pass

print(dps_li)

for data in dps_li:

exist = self.textEdit.toPlainText()

self.textEdit.setText(exist + '연도 : ' + str(data[0]) + ' / 배당금 : ' + str(format(data[1], ",")) + '\n')

# 주가, 배당수익률 비교 그래프

df = pd.read_sql("SELECT code, 일자, 종가, DIV FROM fundamental WHERE code = '" + code + "' AND 일자 >= " + start,

con)

df['일자'] = pd.to_datetime(df['일자'])

df = df.set_index('일자')

df = df[['종가', 'DIV']]

df.columns = ['price', 'DIV']

today_s = datetime.today()

today_s = datetime.strftime(today_s, '%Y%m%d') # 오늘일자를 str으로

start_s = str(int(today_s[:4]) - 3) + today_s[-4:] # 3년전 날짜(파는 것은 좀 더 보수적으로 하기 위해 짧게 잡기)

df_s = pd.read_sql("SELECT 일자, code, 종목명, DIV FROM fundamental WHERE code = '" + code + "'" +

" AND 일자 >= " + start_s, con) # 3년을 기준으로 한 Dataframe

p_max = str(format(df['price'].max(), ","))

p_min = str(format(df['price'].min(), ","))

d_max = str(round(df['DIV'].max(), 2))

d_min = str(round(df['DIV'].min(), 2))

price = str(format(df['price'].iloc[-1], ","))

div = str(round(df['DIV'].iloc[-1], 2))

div_min = str(round(df_s['DIV'].min(), 2)) # 3년내 최소값

div_base = str(round((float(d_max) - float(div_min)) * 0.85 + float(div_min), 2)) # 매수를 할 기준값

p_base = int(dps_li[-1][1] / float(div_base) * 100) #매수 기준가격 계산

sell_base = int(dps_li[-1][1] / ((float(d_max)-float(div_min)) * 0.4 + float(div_min)) * 100) #매도시작 기준가격 계산

profit = round(((sell_base / p_base) - 1) * 100, 2) #수익률 계산

print(profit)

self.lbl_pmax.setText(p_max) #기간내 최고주가

self.lbl_pmin.setText(p_min) #기간내 최저주가

self.lbl_dmax.setText(d_max) #기간내 최고 DIV

self.lbl_dmin.setText(d_min) #기간내 최저 DIV

self.lbl_price.setText(price) #최근주가

self.lbl_div.setText(div) #최근 배당수익률

self.le_start.setText(start) #데이터 시작일

self.lbl_buy.setText(div_base + ' / ' + format(p_base, ",") + '원 이하') #매수기준 배당률 및 매수가격

self.lbl_3ymin.setText(div_min + ' / ' + format(sell_base, ",") + '원 이상 (' +

str(profit) + '%) 예상') #3년기준 최저 배당률 및 매도가격

plt.rcParams['figure.figsize'] = (16, 9)

fig, ax1 = plt.subplots()

ax1.set_xlabel('Date')

ax1.set_ylabel('price')

ax1.plot(df.index, df['price'], color='red', label='Price')

ax1.legend(loc='upper left')

ax2 = ax1.twinx()

ax2.set_ylabel('DIV')

ax2.plot(df.index, df['DIV'], color='blue', label='DIV')

ax2.legend(loc='upper right')

plt.title(name)

plt.show()

def kospi_ex(self):

ex = pdr.get_data_yahoo('USDKRW=X', '2000-01-04') # 환율데이터 가져오기

kospi = pdr.get_data_yahoo('^KS11', '2000-01-04') # KOSPI 데이터 가져오기

df = pd.DataFrame({'KOSPI': kospi['Adj Close'], 'Exchange': ex['Adj Close']})

df.dropna(inplace=True)

plt.rcParams['figure.figsize'] = (16, 9)

fig, ax1 = plt.subplots()

ax1.set_xlabel('DATE')

ax1.set_ylabel('KOSPI')

ax1.plot(df.index, df['KOSPI'], color='red', label='KOSPI INDEX')

ax1.legend(loc='upper right')

ax2 = ax1.twinx()

ax2.set_ylabel('Exchange Rate')

ax2.plot(df.index, df['Exchange'], color='blue', label='Exchange Rate')

ax2.legend(loc='lower right')

plt.title('Exchange Rate VS KOSPI Index')

exchange = round(df['Exchange'][-1], 2)

kospi_index = round(df['KOSPI'][-1], 2)

date = df.index[-1]

self.lbl_date.setText(str(date))

self.lbl_kospi.setText(str(kospi_index))

self.lbl_ex.setText(str(exchange))

plt.show()

# 배당수익률을 기준으로 종목 선정하기

def filtered_by_div(self):

self.db_update()

con = sqlite3.connect('krx_data.db')

div = self.le_div.text()

# 과거 10년간의 Dataframe 구하기

def filter_by_period(today, ticker):

start = str(int(today[:4]) - 10) + today[-4:]

end = str(today)

df = pd.read_sql("SELECT 일자, code, 종목명, DIV, DPS FROM fundamental WHERE code = '" + ticker + "'" +

" AND 일자 >= " + start + " AND 일자 < " + end, con)

return df

div = self.le_div.text()

today_df = pd.read_sql("SELECT 일자 FROM fundamental ORDER BY ROWID DESC LIMIT 1", con)

# DB에서 마지막 행 구하기

today = today_df['일자'].iloc[0] # 마지막 행에서 날짜 구하기

today_df = pd.read_sql("SELECT 일자, code, 종목명, DIV, DPS, EPS FROM fundamental WHERE 일자 = "

+ today + " AND EPS > 0" + " AND DPS > 0 AND DIV > " +

str(div), con)

# 오늘 날짜 기준으로 Data를 분석하기

to_see_codes = []

count = 0

for code in today_df['code']:

try:

print(len(today_df['code']) - count)

t_df = today_df[today_df['code'] == code]

name = t_df['종목명'].iloc[0]

t_div = t_df['DIV'].iloc[0] # 기준일자의 DIV

df = filter_by_period(today, code)

m = int(len(df['DPS']) / 2)

if df['DPS'].iloc[0] <= df['DPS'].iloc[-1] and df['DPS'].iloc[0] != 0 and \

df['DPS'].iloc[m] <= df['DPS'].iloc[-1]:

if (df['DIV'].max() - df['DIV'].min()) * 0.9 < t_div:

to_see_codes.append([today, code, name, t_div])

except:

pass

count += 1

self.prb.setValue(int(count/len(today_df)*100))

total_df = pd.DataFrame(data=to_see_codes, columns=['기준일', 'Code', '종목명', '배당률'])

print(total_df)

for i in range(len(total_df)):

print(i)

exist = self.te_div.toPlainText()

self.te_div.setText(exist + '기준일 : ' + str(total_df['기준일'].iloc[i]) +

' / CODE : ' + str(total_df['Code'].iloc[i]) +

' / 종목명 : ' + str(total_df['종목명'].iloc[i]) +

' / 배당률 : ' + str(round(total_df['배당률'].iloc[i], 2)) + '\n')

total_df.to_excel('배당률로 선별한 종목 DIV ' + str(div) + '이상' + today + '.xlsx')

# 장단기 미국채권 금리차와 코스피지수 비교

def diff_tr_kospi(self):

kospi = pdr.get_data_yahoo('^KS11', '2000-01-04')

print(kospi)

T10Y2Y = fdr.DataReader('T10Y2Y', '2000-01-04', data_source='fred') # 미국 장단기 금리차

print(T10Y2Y)

df = pd.DataFrame({'KOSPI': kospi['Adj Close'], 'T10Y2Y': T10Y2Y['T10Y2Y']})

df.dropna(inplace=True)

self.lbl_kospi_index.setText(str('{:0,.2f}'.format(int(df['KOSPI'].iloc[-1])))) # 최근 코스피지수

self.lbl_diff_tr.setText(str(round(df['T10Y2Y'].iloc[-1], 2))) # 최근 미국채권 장단기금리 차

minus_df = df[df['T10Y2Y'] < 0] # 금리가 역전된 최근 일자의 데이터 프레임

self.lbl_diff_rate.setText(str('{0:,.2f}'.format(minus_df['T10Y2Y'].iloc[-1]))) # 최근 마이너스 금리차

self.lbl_diff_date.setText(datetime.strftime(minus_df.index[-1], '%Y%m%d')) # 최근 금리차 역전된 날짜

plt.rcParams['figure.figsize'] = (16, 9)

fig, ax1 = plt.subplots()

ax1.set_xlabel('DATE')

ax1.set_ylabel('KOSPI')

ax1.plot(df.index, df['KOSPI'], color='red', label='KOSPI INDEX')

ax1.legend(loc='upper right')

ax2 = ax1.twinx()

ax2.set_ylabel('T10Y2Y')

ax2.plot(df.index, df['T10Y2Y'], color='blue', label='10Y - 2Y Treasury')

ax2.legend(loc='upper left')

plt.title('USA 10Year-2Year Treasury VS KOSPI')

plt.show()

# DOW, NASDAQ, S&P500 지수 보여주기

def dns(self):

dow = pdr.get_data_yahoo('^DJI', '2000-01-04')

snp = pdr.get_data_yahoo('^GSPC', '2000-01-04')

nasdaq = pdr.get_data_yahoo('^IXIC', '2000-01-04')

df = pd.DataFrame({'DOW': dow['Adj Close'], 'S&P500': snp['Adj Close'], 'NASDAQ': nasdaq['Adj Close']})

self.lbl_dow.setText(str('{:0,.2f}'.format(df['DOW'].iloc[-1])))

self.lbl_snp.setText(str('{:0,.2f}'.format(df['S&P500'].iloc[-1])))

self.lbl_nasdaq.setText(str('{:0,.2f}'.format(df['NASDAQ'].iloc[-1])))

plt.rcParams['figure.figsize'] = (16, 9)

fig, ax1 = plt.subplots()

ax1.set_xlabel('DATE')

ax1.set_ylabel('DOW, NASDAQ')

ax1.plot(df.index, df['DOW'], color='red', label='DOW')

ax1.plot(df.index, df['NASDAQ'], color='blue', label='NASDAQ')

ax1.legend(loc='upper left')

ax2 = ax1.twinx()

ax2.set_ylabel('S&P500')

ax2.plot(df.index, df['S&P500'], color='black', label='S&P500')

ax2.legend(loc='center right')

plt.title('DOW & NASDAQ & S&P500')

plt.show()

# DB 업데이트

def db_update(self):

con = sqlite3.connect('krx_data.db')

# 오늘날짜 기준으로 아직 받지않은 Data를 DB에 다운로드 받기

# 영업일을 List로 가져오기

def make_date_list(start, end):

start = datetime.strptime(start, '%Y%m%d')

end = datetime.strptime(end, '%Y%m%d')

dates = [(start + timedelta(days=i)).strftime('%Y%m%d') for i in range((end - start).days + 1)]

b_dates = []

for d in dates:

b_day = stock.get_nearest_business_day_in_a_week(d)

if not b_day in b_dates:

b_dates.append(b_day)

s = random.randint(1, 3)

time.sleep(s)

return b_dates

# Data를 다운로드 받기

def data_download(date):

codes = stock.get_market_ticker_list(date, market='ALL') # code list 만들기

corp = [] # Code와 Name을 저장할 List

for code in codes:

name = stock.get_market_ticker_name(code) # 종목 이름 가져오기

corp.append([code, name]) # Code와 이름으로 리스트를 만들기

df1 = pd.DataFrame(data=corp, columns=['code', '종목명']) # code와 종목명을 데이터프레임으로 만들기

df1.index = df1['code'] # index를 코드로 만들기

df_f = stock.get_market_fundamental_by_ticker(date=date,

market='ALL') # BPS, PER, PBR, EPS, DIV, DPS 가져와서 데이터 프레임 만들기

df_c = stock.get_market_cap_by_ticker(date=date, market='ALL') # 종가, 시가총액, 거래량, 거래대금, 상장주식수 가져오기

time.sleep(1)

df = pd.merge(df1, df_c, left_index=True, right_index=True) # 종목명, 종가, 시가총액, 거래량, 거래대금, 상장주식수

df = pd.merge(df, df_f, left_index=True, right_index=True) # 위에 df + PER, PBR...

# column은 '종목명', '종가', '시가총액', '거래량', '거래대금', '상장주식수', 'BPS', 'PER', 'PBR', 'EPS', 'DIV', 'DPS'

df['일자'] = np.array([date] * len(df))

df = df.set_index('일자')

return df

# DB에서 마지막 행 구하기

db_last_df = pd.read_sql("SELECT 일자, code, 종목명, DIV, DPS FROM fundamental ORDER BY ROWID DESC LIMIT 1", con)

db_last_date = db_last_df['일자'].iloc[0] # 마지막 행에서 날짜 구하기

db_last_date = datetime.strptime(db_last_date, '%Y%m%d')

start_date = (db_last_date + timedelta(days=1)).strftime('%Y%m%d')

# 오늘날짜 구하기

today = datetime.today().strftime('%Y%m%d')

end_date = stock.get_nearest_business_day_in_a_week(today, prev=True)

# 데이터 받아서 데이터프레임으로 합치고, DB에 저장

if start_date < end_date:

try:

dates = make_date_list(start_date, end_date)

print(dates)

for n, date in enumerate(dates):

print(date)

if n == 0:

t_df = data_download(date)

else:

t_df = pd.concat([t_df, data_download(date)])

time.sleep(1) # 혹시나 차단될 수 있으니깐

print(t_df)

con = sqlite3.connect("krx_data.db")

t_df.to_sql('fundamental', con, if_exists='append')

except:

pass

# 보유주식 검토

def my_div(self):

con = sqlite3.connect('krx_data.db')

today = datetime.today()

today = datetime.strftime(today, '%Y%m%d') # 오늘일자를 str으로

start = str(int(today[:4]) - 10) + today[-4:] # 10년전 날짜

start_s = str(int(today[:4]) -3) + today[-4:] # 3년전 날짜(파는 것은 좀 더 보수적으로 하기 위해 짧게 잡기)

codes = ['009150', '044450', '005090', '130580', '003540', '029780', '214320', '136540', '000140',

'271560', '005380', '005930', '002990']

i = 1

for code in codes:

df = pd.read_sql("SELECT 일자, code, 종목명, DIV FROM fundamental WHERE code = '" + code + "'" +

" AND 일자 >= " + start, con) #10년을 기준으로 한 Dataframe

df_s = pd.read_sql("SELECT 일자, code, 종목명, DIV FROM fundamental WHERE code = '" + code + "'" +

" AND 일자 >= " + start_s, con) #3년을 기준으로 한 Dataframe

name = df['종목명'].iloc[-1]

div_max = round(df['DIV'].max(), 2) #검토기간 중 가장 높은 값

div_today = round(df['DIV'].iloc[-1], 2) #오늘기준 배당률

div_min = round(df_s['DIV'].min(), 2) #최소값

div_base = round((div_max - div_min) * 0.85 + div_min, 2) # 매수를 할 기준값

div_min_base = round((div_max-div_min) * 0.4 + div_min, 2) #매도할 기준값

print(name + ' 85% :' + str(round((div_max - div_min) * 0.85 + div_min, 2)))

print(name + ' 80% :' + str(round((div_max - div_min) * 0.8 + div_min, 2)))

print(name + ' 70% :' + str(round((div_max - div_min) * 0.7 + div_min, 2)))

print(name + ' 40% :' + str(round((div_max - div_min) * 0.4 + div_min, 2)))

print(name + ' 30% :' + str(round((div_max - div_min) * 0.3 + div_min, 2)))

print(name + ' 20% :' + str(round((div_max - div_min) * 0.2 + div_min, 2)))

# 매수, 매도, 보유 판단하기

if div_max <= div_today:

comment = ' (적극매수) '

elif (div_max-div_min) * 0.85 + div_min <= div_today:

comment = '(매수시작) ' + str(round((div_max-div_min) * 0.85 + div_min, 2)) + '이상 '

elif (div_max-div_min) * 0.7 + div_min <= div_today:

comment = '(매수관심) ' + str(round((div_max-div_min) * 0.7 + div_min, 2)) + '이상 '

elif (div_max-div_min) * 0.4 + div_min > div_today:

comment = '(20% 매도시작) ' + str(round((div_max-div_min) * 0.4 + div_min, 2)) + '이하 '

elif (div_max-div_min) * 0.3 + div_min > div_today:

comment = '(40% 매도시작) ' + str(round((div_max-div_min) * 0.3 + div_min, 2)) + '이하 '

elif (div_max-div_min) * 0.2 + div_min > div_today:

comment = '(60% 매도시작) ' + str(round((div_max-div_min) * 0.2 + div_min, 2)) + '이하 '

elif (div_max-div_min) * 0.1 + div_min > div_today:

comment = '(80% 매도시작) ' + str(round((div_max-div_min) * 0.1 + div_min, 2)) + '이하 '

elif div_min >= div_today:

comment = ' (전량매도) '

else:

comment = ' (No Action) '

# TextEdit에 표시

exist = self.te_my_div.toPlainText()

self.te_my_div.setText(exist + '[' + code + ' ' + name + '] ' + comment + ' <<오늘 DIV : ' +

str(div_today) + '>> / Max : ' + str(div_max) + ' / 매수시작점 : ' +

str(div_base) + ' / Min : ' + str(div_min) + ' / 매도시작점 : ' +

str(div_min_base) + '\n')

self.prb.setValue(int(i / len(codes) * 100)) # 진행 상태바 표시

i += 1

today_df = pd.read_sql("SELECT 일자 FROM fundamental ORDER BY ROWID DESC LIMIT 1", con) # DB에서 마지막 행 구하기

today = today_df['일자'].iloc[0] # 마지막 행에서 날짜 구하기

self.lbl_my_today.setText(today + '기준 - 검토완료')

if __name__ == '__main__':

app = QApplication(sys.argv)

Window = MainWindow()

Window.show()

app.exec_()

|

cs |

728x90

'파이썬(Python) > 배당투자를 위한 도구' 카테고리의 다른 글

| Tool 업데이트 221231 (0) | 2022.12.31 |

|---|---|

| 주식투자 툴 업그레이드 (0) | 2022.12.26 |

| 주식투자 Tool 업데이트 (0) | 2022.12.04 |

| 주식투자 보조 도구(Tool) (1) | 2022.11.29 |

| Invest Tool Upadate - 소소한 업데이트 (4) | 2022.11.21 |

댓글